stock option tax calculator uk

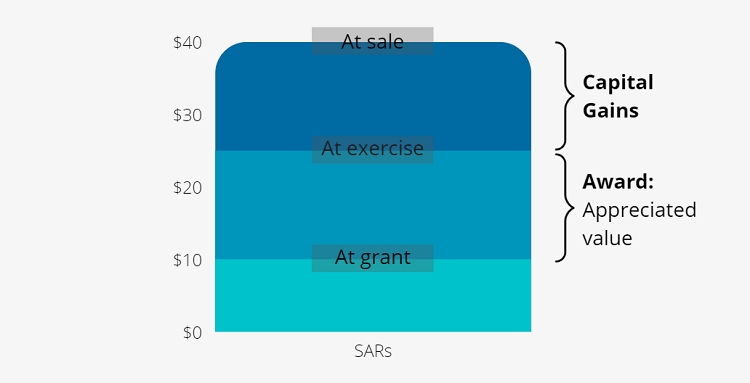

When the option is exercised the option gain is subject to income tax up to 45 in the uk and 37 in the us. As of 2009 the long-term capital gains tax rate is 15 per cent.

Secfi Stock Option Tax Calculator

Online Calculators Financial Calculators Stock Profit Calculator Stock Profit Calculator.

. While if you hold that property or stock. If the scheme is unapproved then any. 10000 options 30 fair market value less 10000 options 1.

Locate current stock prices by entering the ticker symbol. Stamp Duty Reserve Tax SDRT when you. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

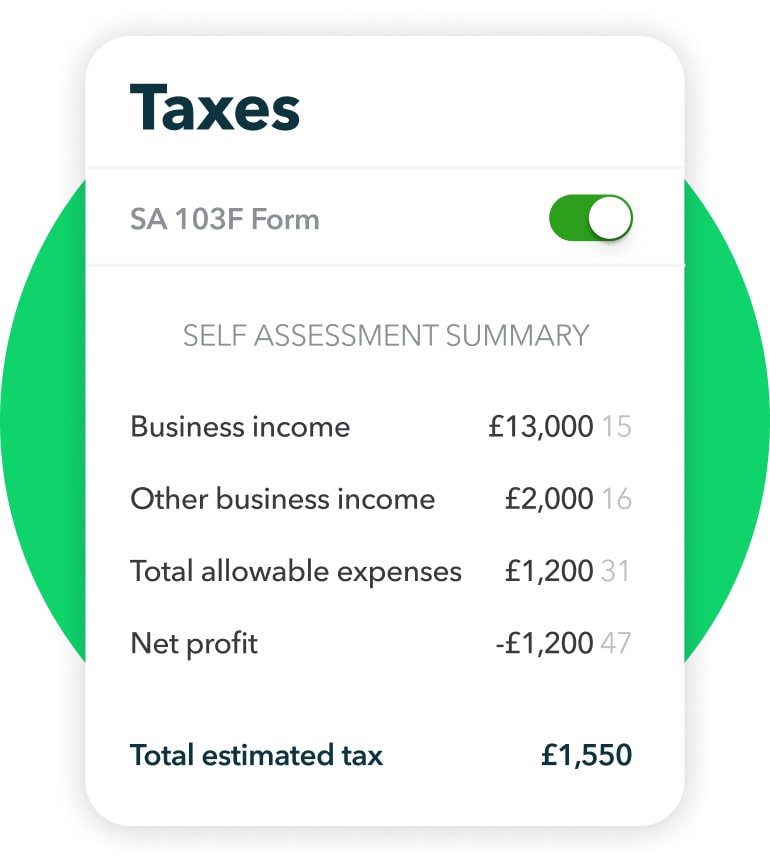

This calculator illustrates the tax benefits of exercising your stock options before IPO. On this page is an Incentive Stock Options or ISO calculator. The 42 best Stock Option Tax Calculator Uk images and discussions of May 2022.

The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. Short-term and long-term capital gains tax. While if you hold that property or stock.

The 42 best stock option tax. Stock option tax calculator uk Friday May 6 2022 Edit. Nonqualified Stock Options NSOs are common at both start-ups and well established companies.

The Stock Option Plan specifies the total number of shares in the option pool. Exercising your non-qualified stock options triggers a tax. Taxes for Non-Qualified Stock Options.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. 60 of the gain or loss is taxed at the long-term capital tax rates. Exercising your non-qualified stock options triggers a tax.

NSO Tax Occasion 1 - At Exercise. You can deduct certain costs of buying or selling your shares from your gain. If you exercise an option to acquire vested shares in an unapproved share scheme then you will be liable to UK PAYE and National Insurance on the difference between the.

Nonqualified Stock Option NSO Tax Calculator. Please enter your option information below to see your potential savings. The same property or stock if sold within a year will be taxed at your marginal tax rate as ordinary income.

Lets say you got a grant price of 20 per share but when you exercise your. Fees for example stockbrokers fees. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

The Stock Option Plan specifies the total number of shares in the option pool.

Rsus A Tech Employee S Guide To Restricted Stock Units

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Stock Appreciation Rights Sars Vs Stock Options What You Need To Know

Equity 101 How Stock Options Are Taxed Carta

Capital Gains Github Topics Github

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

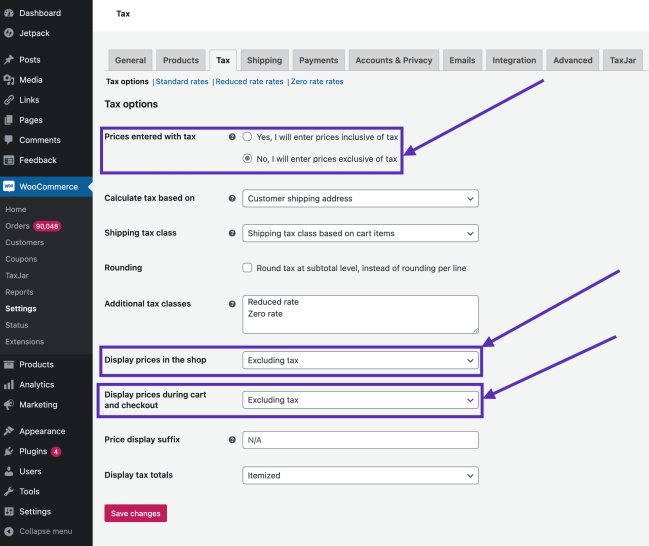

Setting Up Taxes In Woocommerce Woocommerce

Iso Vs Nso What S The Difference

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Setting Up Taxes In Woocommerce Woocommerce

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

What Is The Strike Price Of An Employee Stock Option Exercise Price

Secfi Can You Avoid Amt On Iso Stock Options

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

Incentive Stock Options Turbotax Tax Tips Videos