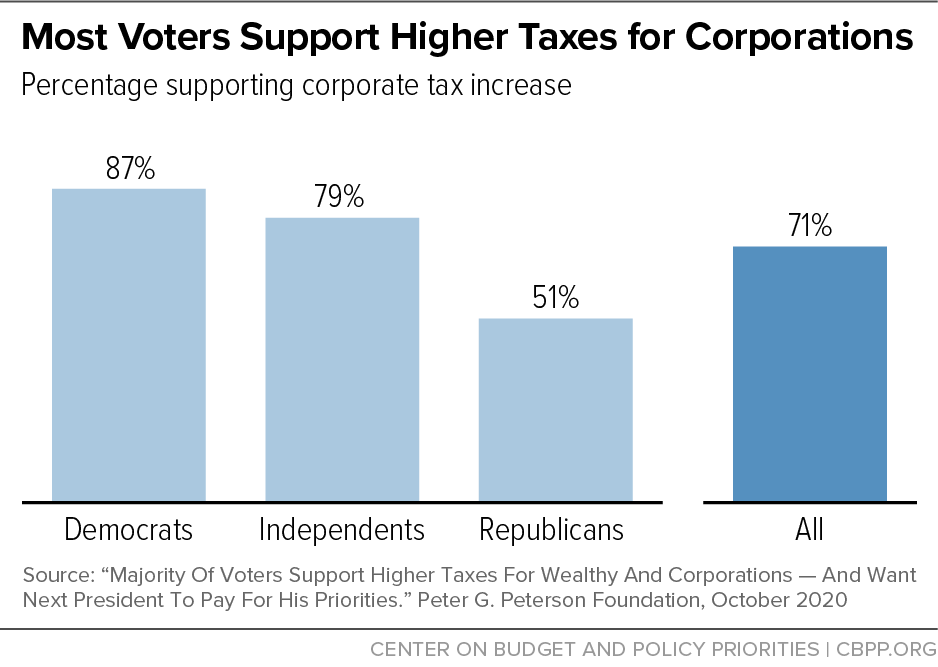

corporate tax increase proposal

28 corporate rate. 396 top individual rate.

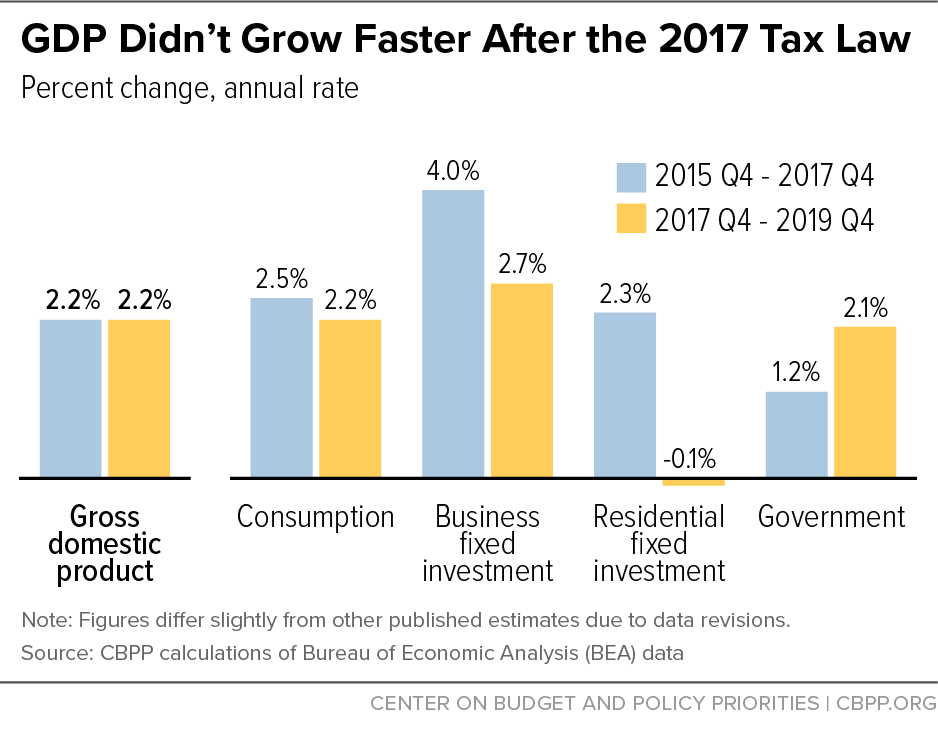

The Relationship Between Taxation And U S Economic Growth Equitable Growth

For corporations with income 2b.

. The House proposal would take huge steps to reverse the 2017 Republican tax cuts. Increase in Corporate Tax Rate. Corporate rate by 55 percentage points raises by far the most revenue among all of the business tax.

The plan would increase the top corporate tax rate to 265 from 21 impose a 3-percentage-point surtax on people making over 5 million and raise. Biden had proposed raising the current corporate. WASHINGTON Sept 12 Reuters - US.

President Bidens administration has made a proposal to increase the corporate tax rate. President Bidens tax proposal would. Increase the corporate tax rate to 28 percent from the current 21 percent rate.

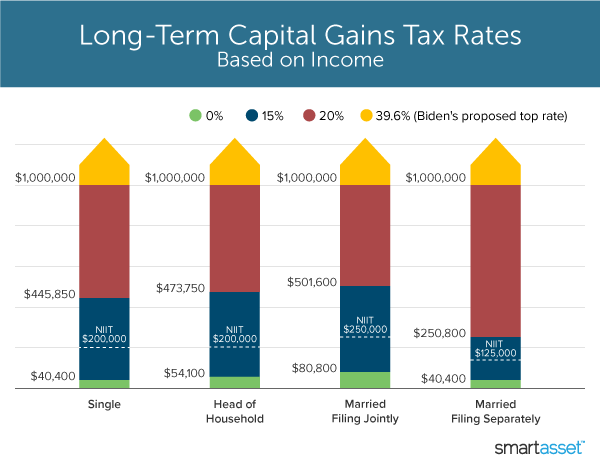

Democrats release details of corporate minimum tax proposal. 396 capital gains rate for incomes over 1m. Corporate profits minimum tax.

The new corporate minimum tax proposal the Corporate Profits Minimum Tax or CPMT would impose a 15 minimum tax on the adjusted financial statement income of applicable corporations that report over 1 billion in profits to shareholders while preserving the value of general business credits eg the research tax credit and allowing. Rather than the 21 enjoyed by many businesses from the Tax Cuts Jobs Act of 2017 C corporations would see a new 28 flat tax rate. The 2022 Tax Plan proposes to increase the headline corporate income tax rate from 25 to 258 for fiscal year FY 2022 and onwards.

This measure also announces that from 1 April 2023 the Corporation Tax main rate for non-ring fenced profits will be increased to 25 applying to profits over 250000. Biden has also called for higher taxes on businesses including hiking the corporate tax rate to 28 from 21 rolling back a key part of Republicans 2017 tax law. Currently the federal tax rate on corporations is 21 down from the 35 rate that was in effect prior to the 2017 Republican tax restructuring.

Eighty-seven percent of these revenues are raised from 5 major changes to the corporate tax code though the proposal to raise the US. 21 percent on income up to 5 million and a rate of 265 on income thereafter. Raises about 191b per year according to JCT.

The international corporate tax changes in President Bidens tax plan would increase tax rates on domestic income more than on foreign income resulting in a net increase in profit shifting out of the US according to our Multinational Tax Model. Enact a new 15 percent minimum tax on book income for large corporations. Leaders of the worlds 20 biggest economies will endorse a US proposal for a global minimum corporate tax of 15 draft conclusions of the two-day G20 summit in Rome showed on Saturday.

Capital-gains taxes would also go up. Increase the minimum corporate tax rate to 21 for all US. Increase the corporate tax rate to 28.

Biden says will raise about 1t and that it will still be much lower than the 35 in 2017. Increases in Capital Gains and Corporate Tax Rates Corporate tax rate would rise to 265 from 21. WASHINGTON New details of a Democratic plan to enact a 15 minimum corporate tax on declared income of large.

The rate structure provides for a rate of 18 percent on the first 400000 of income. Read TaxNewsFlash The proposal would have an effect on the measurement of the existing deferred tax assets and liabilities that are expected to reverse in FY 2022 and onwards. This provision replaces the flat corporate income tax with a graduated rate structure.

The Democratic proposal would raise the top corporate tax rate from 21 to 265 less than the 28 President Biden had sought. Corporate Tax Rate Increase. The proposal would raise the corporate tax rate to 265 percent from 21 percent for businesses that report more than 5 million in income.

The corporate tax rate would be lowered to 18 percent for. 15 minimum tax based on book income. It would hike the corporate rate to 265 after the GOP slashed it to 21 from 35.

Democrats would also restore. Corporations including income from. House Democrats are expected to propose raising the corporate tax rate to 265 from 21 as part of a sweeping plan that includes tax increases on the wealthy.

A separate Tax Foundation analysis based on Census Bureau data shows that Californias population actually declined 08 in 2021 even as states with lower taxes saw their populations increase. Whats in the Democrats Tax Plan. House Democrats are set to propose raising the top corporate tax rate to 265 people familiar with the matter said.

September 12 2021 310 PM PDT Updated on September 13 2021 605 AM PDT.

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

Corporate Tax Reform In The Wake Of The Pandemic Itep

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

The 2020 Election Tax Comparison Trump V Biden Wes Moss

What Could A New System For Taxing Multinationals Look Like The Economist

Us Offers New Plan In Global Corporate Tax Talks Financial Times

What S In Biden S Capital Gains Tax Plan Smartasset

Corporate Tax Reform In The Wake Of The Pandemic Itep

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

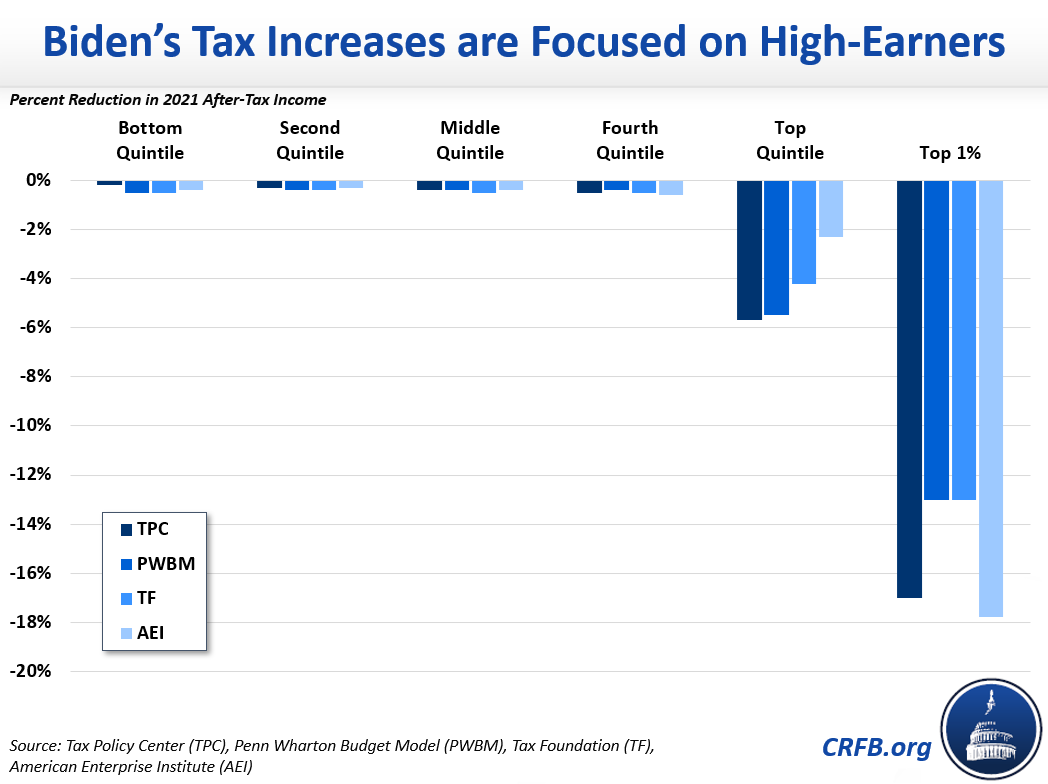

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

What Could A New System For Taxing Multinationals Look Like The Economist

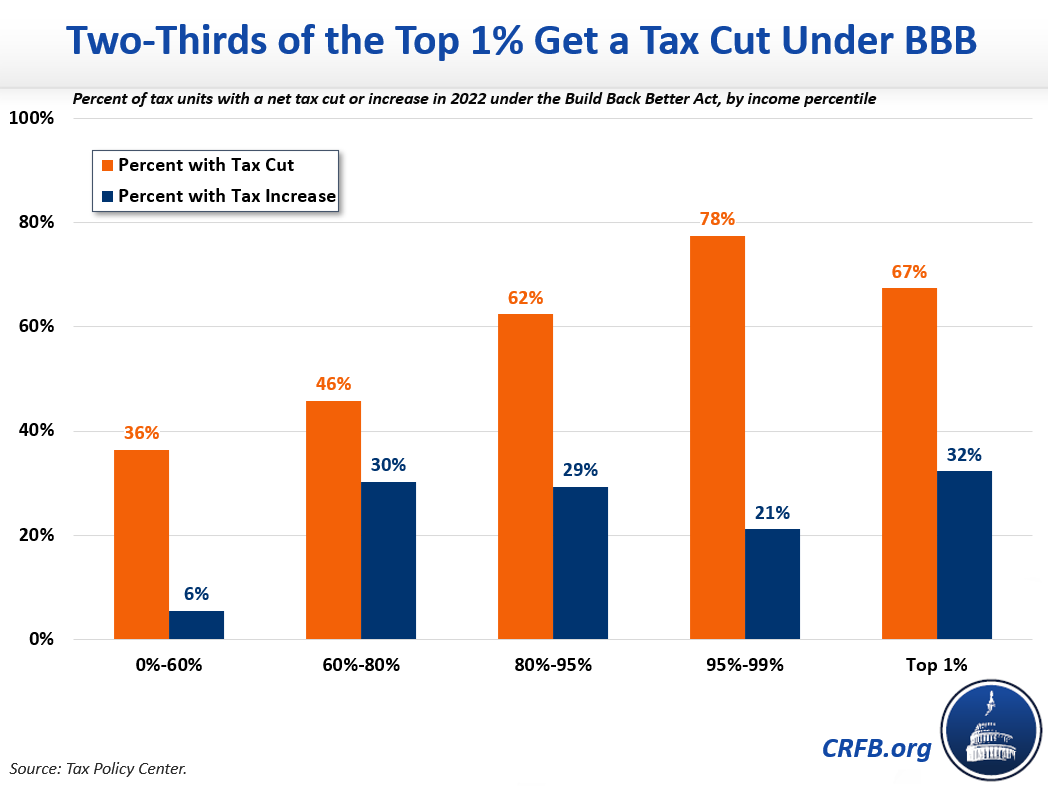

Two Thirds Of The One Percent Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Corporate Lobbying Campaign Against Biden Tax Proposals Is Inaccurate Unpersuasive Center On Budget And Policy Priorities

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)